The cashless pub: is it right for you?

From supermarkets to corner shops people are increasingly making contactless payments using their phones, watches and smart cards. It's probably the same in your pub, but what would happen if you made contactless the only option - what would happen if you went cashless? Let's get into the pros and cons of a cashless pub.

Benefits of a Cashless Pub

Improved Speed of Service

Getting rid of cash can improve your staff's efficiency behind the bar. Card and digital wallet payments will take a lot less time than counting out change for cash transactions. A faster speed of service results in happier customers and more sales at peak times.

Reduced opportunity for mistakes and theft

No matter how diligent your staff are, handling cash transactions during busy times can lead to mistakes. Over time, these mistakes could really cost you. Having cash on hand also invites the possibility of theft or even employee fraud. If employees no longer need to handle cash, this risk is removed.

Saving Staff Time

Taking cash means that employees are spending time counting money every night after closing, and making frequent trips to the bank to deposit funds and get change. With digital transactions, all of the necessary information is already calculated after each shift. Funds are automatically transferred to your bank account, eliminating the need to carry large quantities of cash to the bank.

Improved Sales

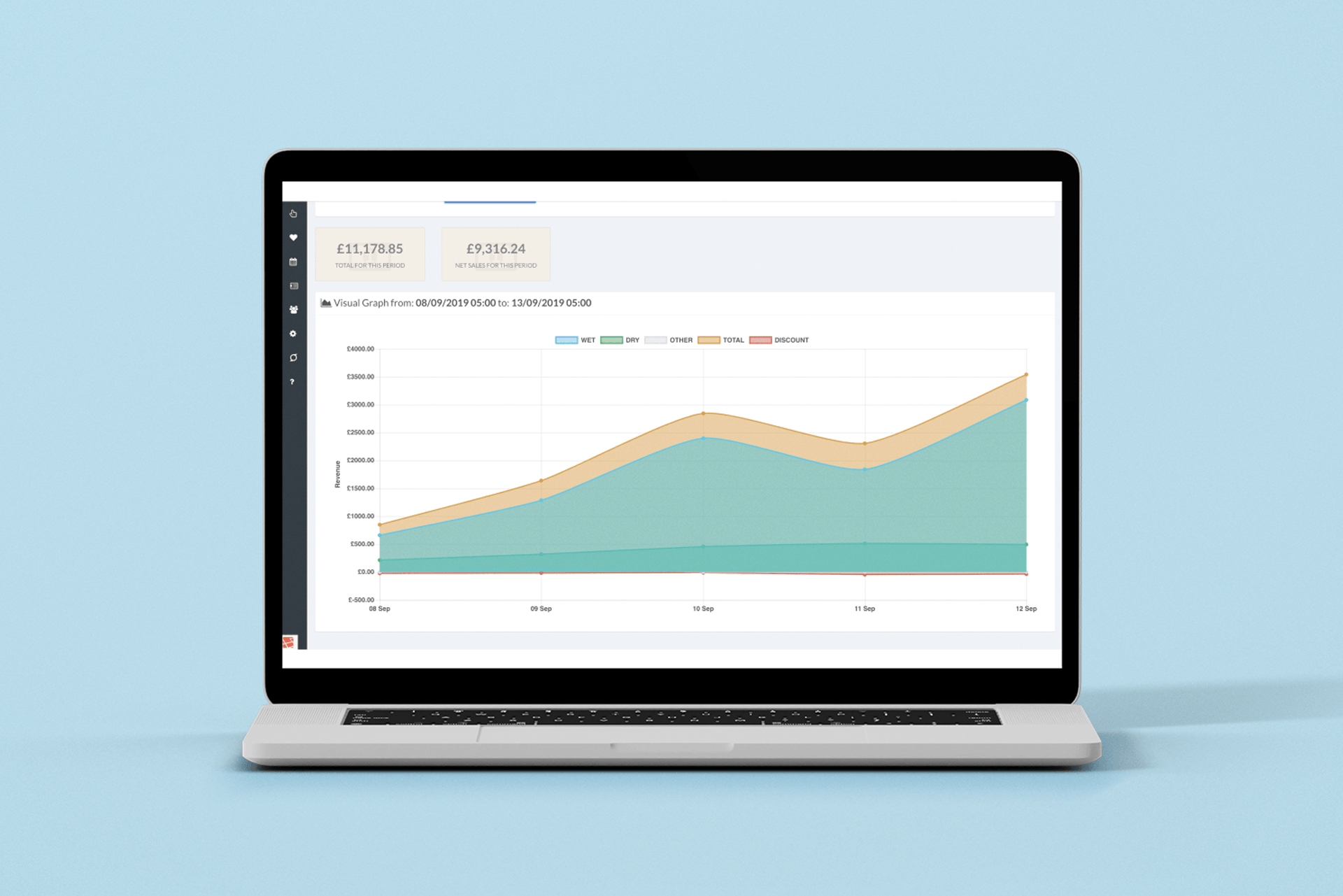

When people pay with cash they're constantly reminded of how much they're spending (and have spent). This isn't the case when they're tapping a card or phone, which means people tend to spend more. With a good pub EPOS system, your staff can also be alerted to upselling opportunities, maximising the benefit.

Potential Downsides of a Cashless Pub

Losing Customers

You may worry that some customers may be so used to paying with cash that they'll find another pub if you go cashless. The good news is that more and more people are relying on credit cards, debit cards, and digital wallet services instead of cash. In fact, in 2016 cash transactions accounted for only 40 percent of all payments, and experts predict that the percentage will drop to 21 percent by 2026.

Many customers who pay with cash would happily use another payment method if asked. But you need to look at your customers - if a lot of them still prefer cash, going cashless may not be right for your pub just yet.

Internet or Technology Failure

If your pub goes cashless, an interruption in internet service or your card processor could be a serious issue. However, this can be mitigated by having backup card processing options. There are many cost-effective, no contract card readers available that can serve very well as a backup. A great option that covers for Internet outages is the SumUp 3G reader.

Cash for Deliveries

You may worry that your pub needs cash to pay for deliveries. If you decide to go cashless, talk to your vendors about alternative payments. They may be willing to accept cheques or offer payment terms if they want to keep your business. You could also keep just enough cash on hand to make payments, although managing that cash would negate some of the benefits of going cashless.

Is a Cashless Pub Right For You?

If you're considering going cashless, it's time to take a close look at whether it will work for you. What are the demographics of your clientele - are they likely to accept a cashless pub? Look at your records and determine if most of your customers already pay without cash.

If you decide going cashless is a good option for your business, we'd be happy to advise you on the right technology to help make the switch. If cash is still too vital to your pub, you can still achieve many of the benefits in this article through strong business processes and a good pub EPOS system.

Either way, get in touch for expert advice from our experienced team.

CONTACT US

Sales 01924 806 074

Support 01924 806 495

Registered Business Address

Tabology Ltd

Avenue HQ

10 - 12 East Parade

Leeds

LS1 2BH

United Kingdom

USEFUL LINKS

NEWSLETTER SIGN-UP

Thank you for subscribing to our blog.

Please try again later.

All Rights Reserved | Tabology